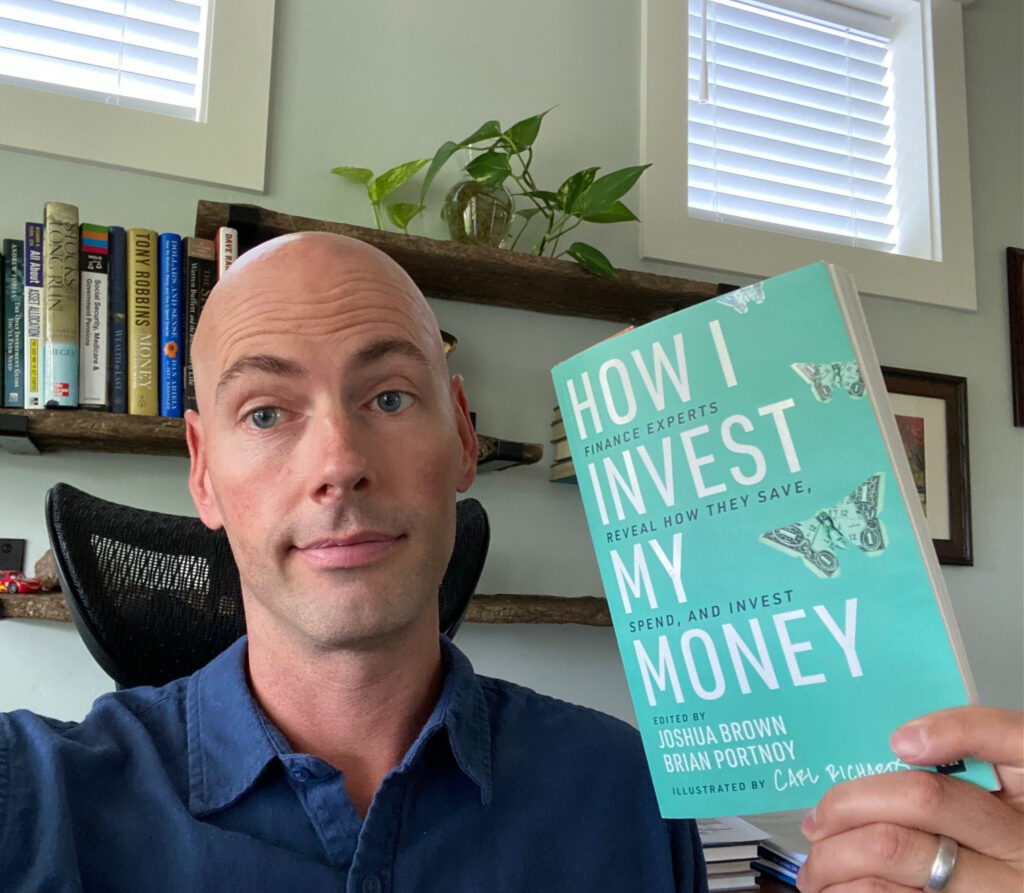

Edited by Joshua Brown and Brian Portnoy

The idea for this book is what reeled me in, “How do the financial commentators on TV actually invest their own money?” Which is exactly what I would ask Jim Cramer if I had the opportunity to sit down and talk. The primary author, is Joshua Brown, an investment advisor in the New York area and a frequent commentator on CNBC. The book is a collection of 25 of his fellow finance experts sharing how they invest their money.

One would think the fancy finance experts would have complicated investment plans with frequent trading, buying options and using margin, that reflect the strategies they discuss on CNBC. However, a majority of the finance experts in the book use a simple investment strategy focused on long term investing in very low expense funds that track the stock market. I don’t want to spoil the book for you, but it was amazing to hear how uncomplicated the people who talk on CNBC invest their money.

One concept that is mentioned in the book and implied by the contributors is the concept of active versus passive investment management. An actively managed fund will essentially pay a manager (or team of managers) to make decisions on how to best manage the assets of the fund. A passively managed fund does not pay a manager to make investment decisions, rather it is designed to mirror an index like the S&P 500 or NASDAQ. This debate is thoroughly discussed in another book, “The Little Book on Common Sense Investing”, but there is a consensus in this book that the low fees of passively managed funds, makes them very attractive investments.

This book is a great read for those who are worried they need to do more buying and selling to get ahead in the stock market. While some of the contributors do have an account set aside, they practice active trading with (this is where they place their stock market “bets”), most simply plan to buy and hold for a long period of time. This book has 25 contributing authors and at time use some terminology for investments that might be a bit advanced for those not familiar with them.